Insight and transparency into your trust account are a must for every attorney, but it can be challenging to know exactly which reports will give you the most thorough overview of your account. With an endless number of reports at hand, attorneys can be overwhelmed with choices, a situation that often leads to decision paralysis and an ineffective monthly review.

The trust account is too important and the penalties for mismanagement are too severe not to have a defined process and a clear set of reports. Attorneys need to strike a balance in their monthly review between efficiency and completeness, and getting into a monthly rhythm with a defined set of reports will help to accomplish these goals.

But how do you know which reports will strike that balance between efficiency and insight and give you the peace of mind that your review is complete? We’ve put together a list of six reports that should be included in a consistent monthly review of your trust account:

1. Three-Way Reconciliation Report

What is this report? The three-way reconciliation report compares your bank balance, your trust ledger balance, and the sum of your client balances at month-end.

Why is it important? For any trust account, this is the ultimate reconciliation report. State bar associations require this report to be completed on a periodic basis—either monthly or quarterly, depending upon the state. Since you are required to track each transaction to each client, the three-way reconciliation ensures this is being completed and highlights any clients whose accounts have gone into the negative

Tips and Tricks: Don’t be fooled into thinking that your general accounting software will automatically generate this report when you reconcile. General accounting programs (think QuickBooks), only perform a two-way reconciliation that compares your bank balance to your trust ledger; they do not incorporate your client balances. This can cause a lot of panic and anxiety for attorneys who only think they are properly meeting this requirement by doing a reconciliation in their software.

2. Detailed Reconciliation Report

What is this report? This report provides the supporting detail of the reconciliation between your bank account and your trust ledger. It shows all the cleared items from your trust ledger (i.e., transactions that showed up on your bank statement) as well as the uncleared or outstanding items from your trust ledger (i.e., transactions that were processed but have yet to show up on a bank statement).

Why is it important? This report is the foundation of any good accounting process. When maintaining your trust ledger, you need to periodically (usually monthly) compare your internal accounting records, or trust ledger, to your bank statement. This gives you the confidence that your internal accounting records are complete and accurate.

Tips and Tricks: Get into the habit of doing your monthly detailed trust reconciliation on a timely basis, preferably within the first 10 days following month-end. This will help you catch and resolve any errors in a timely fashion.

3. Client Activity Report

What is this report? This is a single report that lists each client, shows their balance at the beginning of the month, lists their activity, and calculates their balance at month-end.

Why is it important? This single report is a great tool to review all your clients and their activity for the month. You get a quick and easily consumable snapshot that gives insight into account activity on a client-by-client basis, making this report an extremely valuable addition to your month-end review.

Tips and Tricks: Spend 5 – 10 minutes reviewing this report each month to quickly identify high-level issues, such as irregular activity, clients’ with negative balances, or missing transactions. The report may not be able to help you resolve the issues, but it’s a great first step in identifying potential problems.

4. Trust Ledger Report

What is this report? This report, which can also be called a check register, general ledger, statement of costs and receipts, etc., tracks all the transactions into and out of your trust account(s). It’s a high-level report that does not separate out each transaction by client (although good trust accounting software will include the client information for each transaction).

Why is it important? This is your fundamental accounting report that tracks all activity into and out of your trust account—you need this to compare and reconcile back to your bank statement.

Tips and Tricks: Make sure that each transaction on your trust ledger gives you the information you need to do any follow-up research (i.e., date, client, matter, description, amount, etc.). If you ever need to resolve an issue within your trust accounting, this report will likely be used to take action, and, by ensuring you’ve captured all the right data for each transaction, you can make changes quickly and efficiently. In the real world, mistakes will be made, so it’s best to have a clear and easy way to correct them.

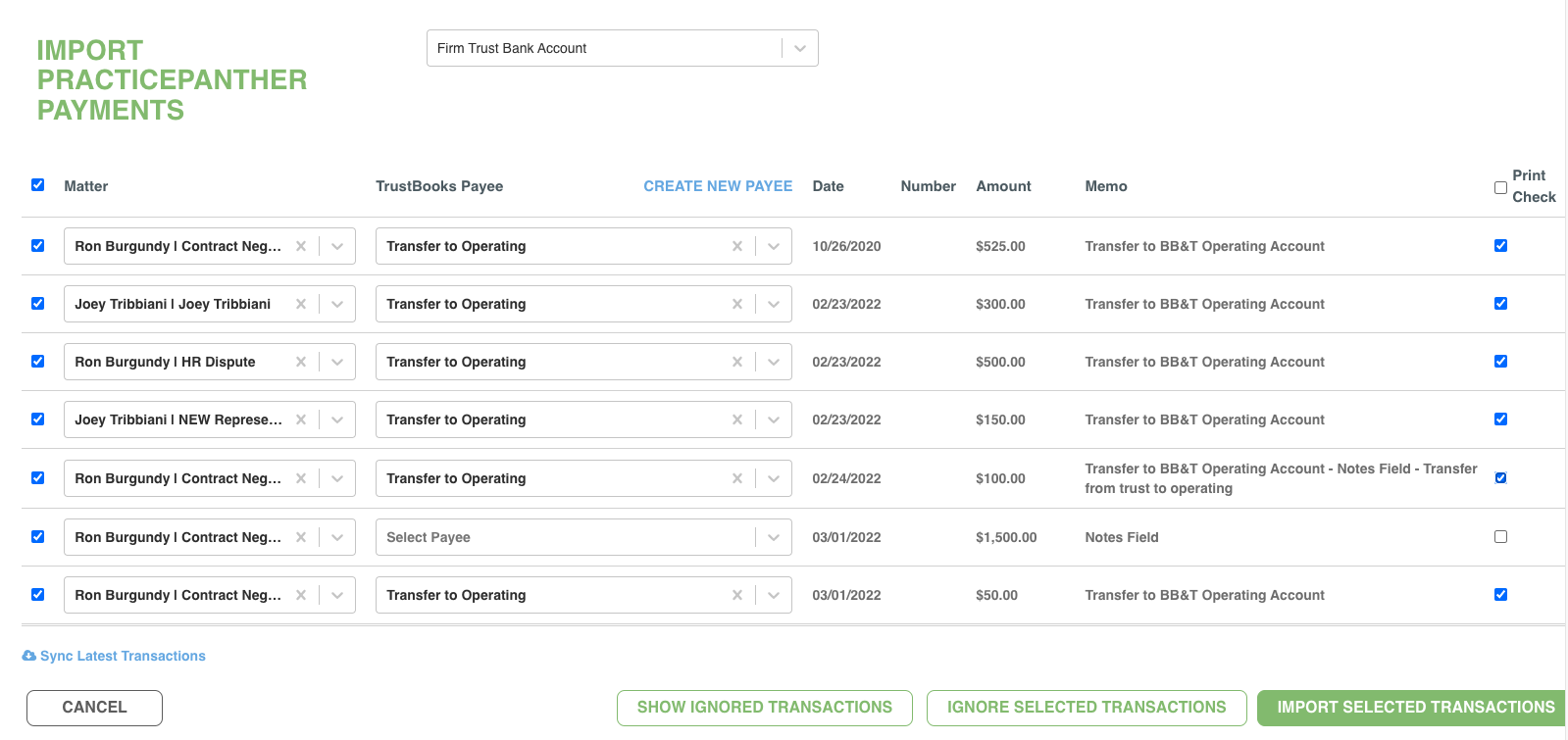

5. Payments Report

What is this report? This report tracks all the payments that left your trust account for the month.

Why is it important? This report can be used as a great tool to check for fraud by scanning all payments and comparing them to your bank statement. In addition, you can also use this report to check your accounting processes. If you start to see a lot of voided checks, irregularities in check information, etc., this report will highlight those areas and prompt you to perform follow up procedures.

Tips and Tricks: When checking for fraud, take a sample of checks that have cleared your bank during the month (start with the bank, not your payments report) and compare the information on the checks to your payments report. Look for discrepancies or irregularities in the following fields: check number, payee, payee address, amount, signature line, and endorsement. This can be a quick exercise and it will add a level of internal control to your monthly review, allowing for any frauds to be recognized and acted upon immediately.

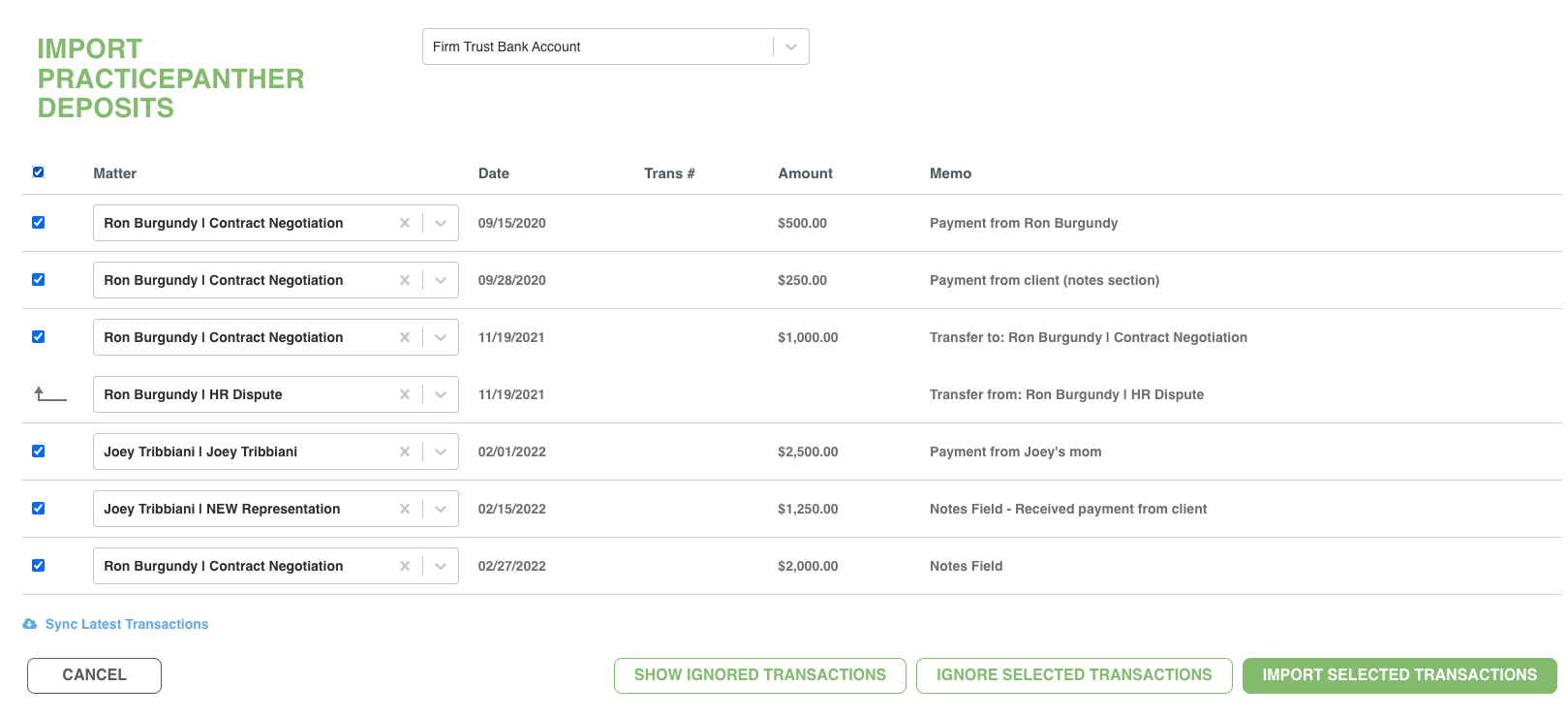

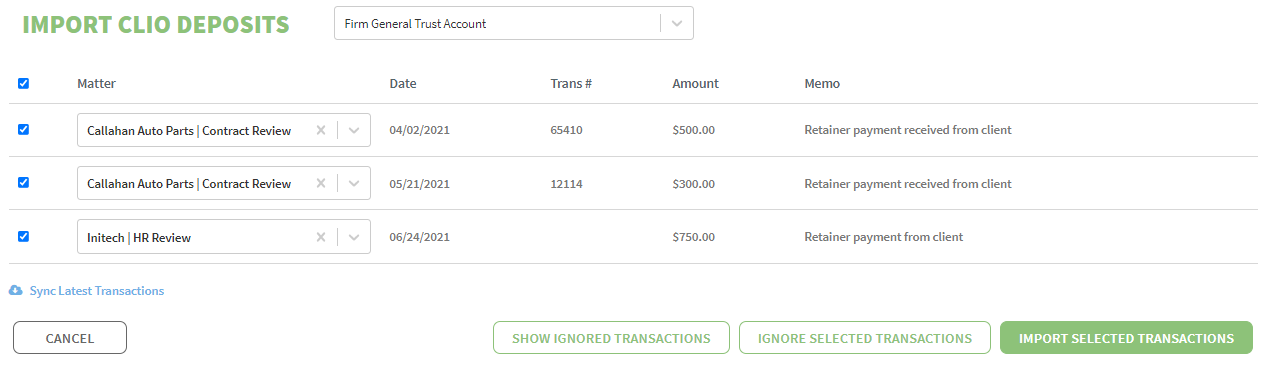

6. Deposits Report

What is this report? This report provides a breakdown of each deposit made during the month.

Why is it important? Typically, when you look at the deposits on your bank statement, they show up as one lump sum—there’s no breakdown of the actual checks or credit card transactions. With this report, you’ll have that breakdown, and reviewing it will give you greater insight into the makeup of each deposit.

Tips and Tricks: When you do your reconciliation at month-end, use this report as a short cut to confirm the deposits on the bank statement against your internal accounting records.

By using these reports as the foundation for consistent month-end reviews of your trust account, you can add transparency to the trust accounting process and help identify any potential issues. What’s more, being diligent and consistent in your monthly review will give you the peace of mind that your trust account is complete, accurate, and free from fraud!