What is a trust account?

A trust account is a special bank account that a lawyer or law firm must maintain in order to receive and hold money on behalf of their clients or third parties.

Why does a lawyer need a trust account?

A lawyer takes on the role of a fiduciary when representing a client, meaning that the lawyer has a high level of responsibility to that individual. As a fiduciary, a lawyer may receive funds belonging to a client or a third party, and, to reduce the risk of that money being used incorrectly, the lawyer must place it in a trust account for safekeeping. Trust accounts are closely regulated both by law firms and by state bar associations, making them a secure place in which to hold client funds.

Why would my money be put into a trust account?

Trust accounts are used by law firms to hold client funds that they have accumulated through a variety of different means, including:

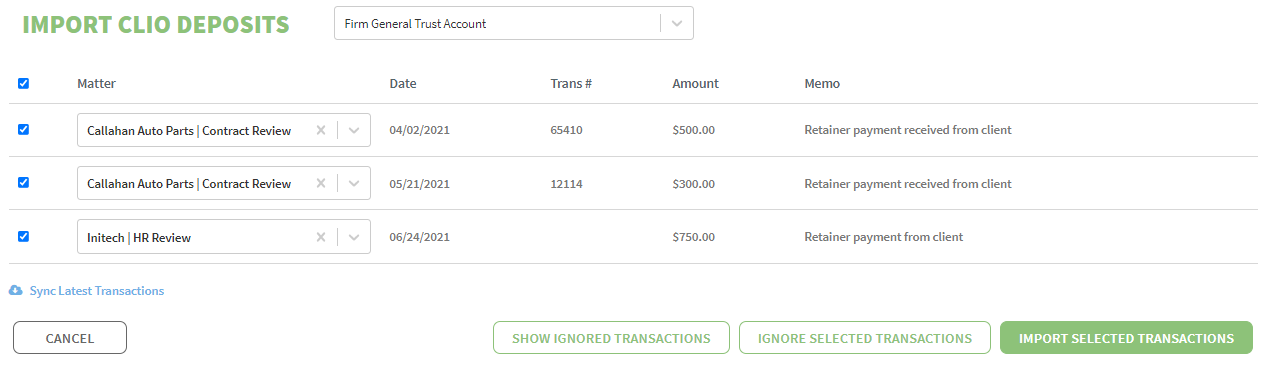

- Retainers: Lawyers often charge a retainer when they first begin to represent a client. In many cases, this retainer acts as a security deposit to be used against future billings by the lawyer. For example, as a lawyer performs work for the client and generates invoices, the lawyer can then pay those invoices with the funds already deposited in their trust account. In these instances, there should be some agreement between the lawyer and client, usually an engagement letter, that spells out the various ways in which the retainer can be used.

- Legal Settlements: Legal settlements, such as workers’ comp awards or personal injury settlements, are often paid by insurance companies directly to a lawyer, who received the funds on behalf of their client. These settlements must immediately be deposited into a trust account to be held until distributed by the lawyer to their client.

- Real Estate Transactions: A lawyer who performs real estate transactions will often have funds related to those transactions flowing through their trust account. In many cases, a lawyer will maintain a separate trust account dedicated exclusively to handling real estate transactions such as escrow payments, loan payoffs, real estate agent commissions, homeowners’ insurance payment, etc.

How do I know that my money is safe in a trust account?

Trust accounts are governed by a number of rules and regulations that are set by the state bar in order to assure the sanctity of a client’s funds. These rules are enforced by the state bar and violations can result in disciplinary action against the attorney or law firm. Regulations include:

- A lawyer may not comingle or mix, any personal funds with funds received on behalf of a client or third party.

- A lawyer must maintain a separate client ledger for each client whose money is in their trust account. The client ledger records all transactions that flow into and out of the trust account for that specific client. A client can ask to see their ledger at any time, and a lawyer must send each client their ledger at least once per year or as soon as all the client’s money held in trust has been distributed.

- Lawyers must reconcile their trust account every month to compare their internal accounting records against their trust bank statement. This process helps ensure good recordkeeping and will uncover any issues.